Future Value of Annuity is an important finance topic and getting to know about this will definitely help you out in various finance related problems. As we have already discussed about Annuity in our Present value of Annuity post, we do not need to explain annuity again. However, if we need to buy some asset today such as a car, we need to deposit certain amount every year. This will help us in meeting the requriement to buy the car.

Formula

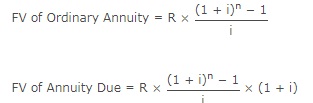

The formula to calculate future value of annuity is as follows:

Where:

R = Periodic payments

i = interest rate

n = number of compounded periods

Example

Simon is investing $ 15,000 into an scheme which pays out 12 {1bb28fb76c3d282be6cfd0391ccf1d9529baae691cd895e2d45215811b51644c} per annum. Compounding is done on monthly basis. Calculate future value of annuity after 03 years when:

$ 15,000 is invested at the end of each month,

$ 15,000 is invested at the start of each month.

Solution

Here:

R = 15,000

i = 12 {1bb28fb76c3d282be6cfd0391ccf1d9529baae691cd895e2d45215811b51644c} / 12 = 1 {1bb28fb76c3d282be6cfd0391ccf1d9529baae691cd895e2d45215811b51644c}

n = 3 x 12 = 36

Now, we will plug values above into the future value formula:

FV Ordinary annuity = 15,000 x [(1.01)^36 -1] / 0.01 = $ 646,153/-

FV Annuity Due = 646,153 x 1.01 = 652,615